- 1 5 Powerful Insights About Ambetter Health Insurance: Is It Right for You in 2025?

- 1.1 1. Affordable Health Insurance Plans Tailored to Your Needs

- 1.2 2. Extensive Provider Network Nationwide

- 1.3 3. Customer Service: Mixed Feedback from Yelp and Trustpilot

- 1.4 4. Convenient Access and Contact: Ambetter Health Insurance Phone Number

- 1.5 5. Is Ambetter Health Insurance Right for You in 2025?

5 Powerful Insights About Ambetter Health Insurance: Is It Right for You in 2025?

As we step into 2025, choosing the right health insurance has never been more critical. With the healthcare landscape constantly evolving, consumers have a wide variety of options to choose from. One name that often comes up in conversations about affordable coverage is Ambetter Health Insurance. Known for its broad range of affordable plans, Ambetter offers healthcare benefits through both the Affordable Care Act (ACA) marketplace and Medicaid. However, while the insurance may seem like an attractive option, it’s essential to consider all angles before committing.

In this article, we’ll take a deep dive into Ambetter Health Insurance, providing 5 powerful insights that will help you decide if it’s the right choice for your healthcare needs in 2025. Along with coverage details, we’ll also examine Ambetter Health Insurance reviews from platforms like Yelp and Trustpilot and give you important contact details, such as the Ambetter Health insurance phone number and how to pay by phone.

1. Affordable Health Insurance Plans Tailored to Your Needs

In 2025, one of the most important factors when considering a health insurance plan is affordability. Ambetter Health Insurance is known for offering budget-friendly options, especially through the ACA marketplace. Whether you’re looking for basic coverage or a more comprehensive plan, Ambetter offers various levels of coverage that can fit most budgets.

Ambetter’s plans typically fall into the following categories:

- Bronze Plans: The most affordable, with higher deductibles and co-pays but lower monthly premiums.

- Silver Plans: A balance of affordability and coverage, with more reasonable deductibles and better coverage for healthcare services.

- Gold and Platinum Plans: Higher monthly premiums but lower deductibles, ideal for those who anticipate needing frequent medical care.

These plans often include healthcare benefits such as:

- Preventive services like immunizations and screenings

- Prescription drug coverage to manage chronic conditions

- Emergency services, including hospital stays and surgery

- Mental health services, a crucial offering in today’s healthcare environment

If you’re eligible for ACA subsidies, Ambetter’s premiums can be significantly reduced, making it an attractive option for individuals and families seeking affordable health coverage.

Read More Article

What Types of Insurance Coverage Does First Chicago Insurance Offer?

How Cyber Insurance Coverage Silverfort Enhances Security and Lowers Premiums

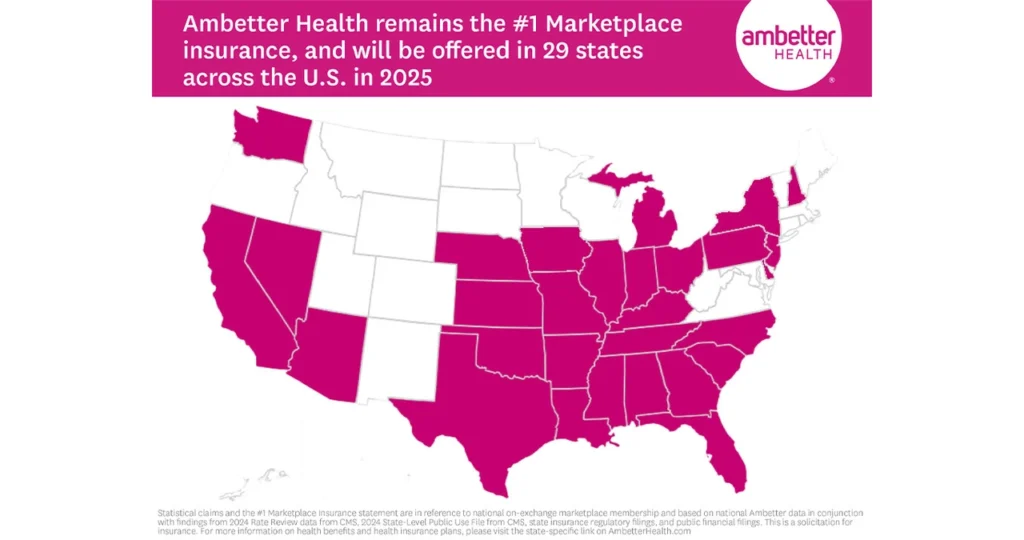

2. Extensive Provider Network Nationwide

Ambetter Health Insurance is available in several states across the country, and one of its strengths is its extensive provider network. Whether you’re seeking care in an urban area or in a more rural location, Ambetter has a large number of in-network providers.

This is a critical factor when selecting health insurance, as a broad provider network means that you’re more likely to find doctors, specialists, and hospitals that accept your plan. Ambetter collaborates with a range of health professionals, ensuring that you can access quality care when you need it.

However, before enrolling in an Ambetter plan, it’s always advisable to check the network’s availability in your area. While Ambetter’s provider network is robust, it’s important to confirm that your preferred doctor or healthcare provider participates in the plan to avoid out-of-network charges.

3. Customer Service: Mixed Feedback from Yelp and Trustpilot

As with any health insurance provider, Ambetter Health Insurance has garnered both positive and negative reviews from customers, particularly when it comes to customer service and claims processing. These insights can play a significant role in your decision-making process.

Ambetter Health Insurance Reviews on Yelp

On Yelp, reviews for Ambetter Health Insurance are mixed, with both praise and complaints regarding different aspects of the service. On the positive side, many customers appreciate the affordability and comprehensive healthcare benefits that come with their Ambetter plans. They highlight the easy enrollment process and the coverage options that cater to individuals with various healthcare needs.

However, many Yelp reviews also point out customer service challenges. Long wait times, unhelpful responses, and difficulties with resolving billing issues have been recurring complaints. Users have expressed frustration with the lack of clear communication and the delayed processing of claims, which can lead to financial stress.

Ambetter Health Insurance Reviews on Trustpilot

Similarly, on Trustpilot, Ambetter has garnered mixed reviews, with an average rating of around 3 out of 5 stars. The positive reviews emphasize the affordable premiums and decent coverage options for essential health services. Many users feel that Ambetter Health Insurance provides value for money, particularly for those who are eligible for subsidies through the ACA marketplace.

On the other hand, negative reviews highlight issues such as slow claims processing, billing errors, and unresponsive customer service. Many users have expressed frustration with Ambetter’s customer support, claiming they’ve encountered long wait times and unclear explanations about the terms of their coverage.

Overall, while Ambetter Health Insurance reviews from both Yelp and Trustpilot reveal a mixed reputation, the service is often seen as a good option if you’re looking for affordable health insurance. However, be prepared for the possibility of navigating some customer service challenges.

4. Convenient Access and Contact: Ambetter Health Insurance Phone Number

One of the most important aspects of any health insurance plan is how easy it is to get in touch with the provider when you have questions or need assistance. Ambetter offers several ways for customers to reach their support team, making it easier to manage your account, ask questions about your healthcare benefits, and resolve any issues that may arise.

Ambetter Health Insurance Phone Number

If you need assistance, the Ambetter Health Insurance phone number is a key resource. The main customer service number for Ambetter is:

- 1-877-687-1169 – This number is available for general inquiries, claims questions, or information about your health insurance coverage. If you require more specialized help, like help navigating your member portal or resolving a billing issue, this is the number to call.

Paying Your Ambetter Premiums by Phone

If you need to pay your Ambetter Health Insurance premium by phone, you can also use this number. Customer service representatives can assist you with making payments, ensuring that you never miss a payment, and continue to maintain your health insurance coverage without any interruptions.

In addition to calling, you can also make payments online through Ambetter’s website or mobile app, providing a range of payment options to fit your preferences.

5. Is Ambetter Health Insurance Right for You in 2025?

After examining Ambetter Health Insurance’s plans, provider network, customer feedback, and contact information, the next question is whether it’s the right fit for your needs in 2025.

If you’re someone who values affordable premiums and comprehensive healthcare benefits, and you’re willing to be patient with occasional customer service delays, Ambetter Health Insurance could be a strong option.

It’s particularly ideal for individuals or families who qualify for ACA subsidies, as these can significantly reduce monthly costs. Ambetter offers a wide range of plans, from the low-cost Bronze plans to more comprehensive Gold and Platinum options. With extensive coverage for preventive care, emergency services, prescription drugs, and mental health, it provides a good foundation for overall health management.

However, if you place a high premium on efficient customer service and quick claims processing, Ambetter’s customer support might not meet your expectations. Reviews on platforms like Yelp and Trustpilot suggest that while Ambetter offers great value, its customer service is an area that could use improvement.

Final Verdict: Make an Informed Choice for 2025

Ultimately, Ambetter Health Insurance can be an excellent choice for those who need affordable, quality health insurance and are prepared to navigate some customer service challenges. Make sure to assess your specific healthcare needs, evaluate your budget, and consider potential issues with customer service before making a decision.

If you’re ready to explore Ambetter Health Insurance, be sure to call the Ambetter Health Insurance phone number at 1-877-687-1169 for further information or to inquire about paying by phone. And remember, Ambetter Health Insurance reviews on platforms like Yelp and Trustpilot can offer additional insights into the experiences of other members, helping you make the most informed decision for you and your family.

1 thought on “5 Powerful Insights About Ambetter Health Insurance, Is It Right for You in 2025?”