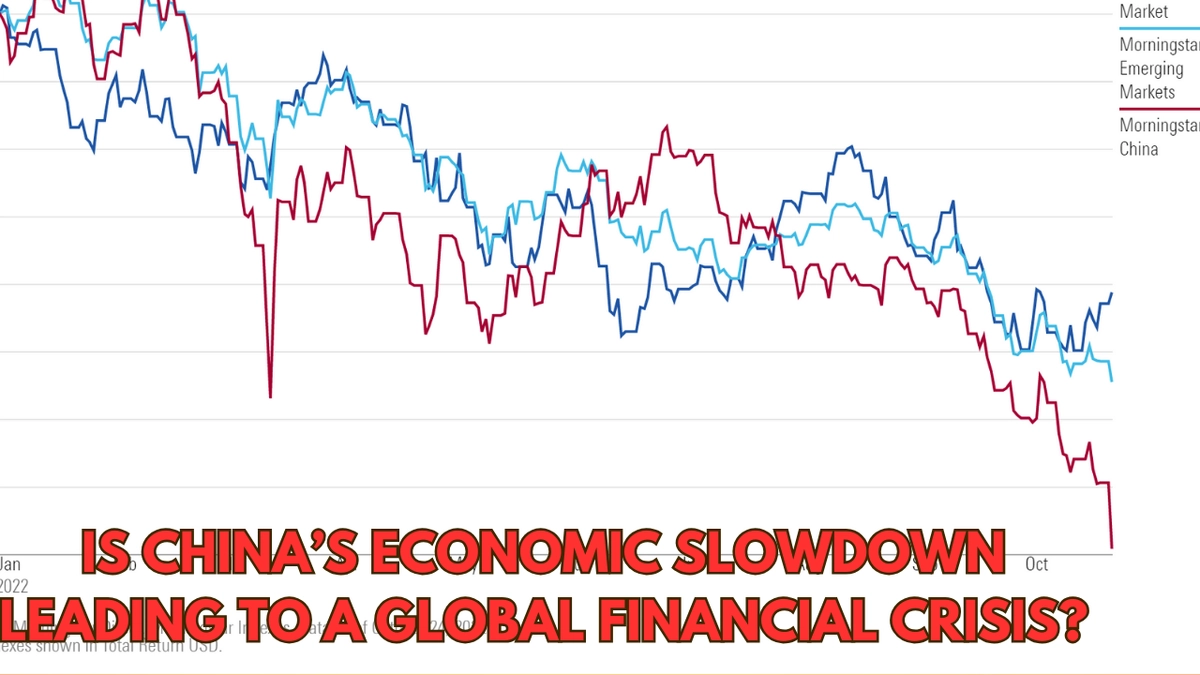

Asia (Chinese)Stocks Start 2025 in the Red Amid Economic Woes Chinese stock markets have entered 2025 with a significant slump, as investor sentiment remains dampened by ongoing economic challenges and external geopolitical pressures. After a mixed performance in 2024, Chinese stocks kicked off the new year on a sour note, as the benchmark Shanghai Composite Index and other key indices registered sharp declines in early January. The downturn reflects a growing sense of caution among both domestic and international investors, who are grappling with several unresolved issues affecting China’s economic recovery.

Asia (Chinese)Stocks Start 2025 in the Red Amid Economic Woes

The Chinese stock market has seen a rough start to 2025, with the Shanghai Composite Index dropping by over 2% in the first week of trading. The decline has been attributed to a combination of factors, including slowing economic growth, weak consumer spending, and ongoing concerns in the real estate sector. Despite various policy measures aimed at stimulating the economy, domestic demand has not picked up as expected, and the recovery remains sluggish.

South Korea’s Export Boom: Unprecedented Growth Driven by Surging Chinese Demand

Analysts are particularly worried about the stagnation in the property market, where many developers are still burdened with heavy debt, and the youth unemployment crisis continues to strain the domestic economy. The combination of these economic woes has made investors wary, and the Chinese stock market has failed to capitalize on any optimism that might have carried over from 2024.

Global Uncertainty Adds to Pressure: Chinese Stocks Start 2025 in the Red

In addition to domestic issues, global uncertainty has increased pressure on Chinese stocks. The ongoing trade tensions with the United States and geopolitical instability in Europe and Asia have left investors jittery. China’s economic growth relies heavily on its exports, and any disruptions to global trade can exacerbate the difficulties local companies face.

Furthermore, inflationary pressures in other major economies, such as the United States and Europe, are fueling concerns over global growth. Despite efforts by China to stabilize its economy, the global economic environment remains volatile, making it difficult for Chinese stocks to rebound. The Chinese yuan has also faced depreciation against the U.S. dollar, adding another layer of uncertainty to the market’s outlook for the year.

Can the Market Recover? Chinese Stocks Start 2025 in the Red

The big question now is whether Chinese stocks can recover from this early setback in 2025. Some analysts believe that government intervention, including fiscal stimulus and monetary easing, could eventually help boost investor confidence and stimulate growth. However, many also caution that without significant structural reforms and a clear path forward, the Chinese economy may struggle to regain momentum.

Despite the initial challenges, there are pockets of optimism in sectors such as technology and green energy, where the Chinese government has been focusing its investments. However, the overall economic climate remains fragile, and investors are closely watching the government’s next moves to determine whether there is hope for a rebound in the coming months.

In conclusion, Chinese stocks start 2025 in the red amid economic woes and global uncertainty, facing multiple challenges that could make for a rocky year ahead. While there may be opportunities for recovery, the path forward appears uncertain, and investors are likely to remain cautious as they navigate the complex landscape of China’s economic future.